Liquidity is generally defined as the ability to purchase or sell an asset without causing a dramatic change in price. However, this definition can be misleading as throughout the history of markets, we have seen securities trade with big price moves, often on large volumes. News comes out and someone is the first trade of the stock or bond at say 30% below the previous price, and then other trades ensue. Markets at times are volatile. We can’t regulate risk out of the market, nor should we. Risk has been and will always be part of investing, but theory also holds that as investors take on risk so does the ability to generate returns. I don’t think we want to live in a “riskless” world whereby we are only generating what you could get on “riskless” government debt.

Liquidity has been a major topic of focus for investors considering allocating to the high yield bond market, especially given the heightened media attention the issue has garnered recently. The concerns with liquidity stem from market regulations put in place over the past few years. With the implementation of Dodd Frank and the Volcker Rule within it, along with Basel III, market making in high yield debt has been impacted. Dealer inventory now sits at all-time lows.1

Dealer Inventory as a % of Market

As dealers have become significantly less of a force within market trading, times of sell pressure, such as we have seen over the past year, have resulted in more significant price markdowns. Buy and sell pressure has always existed in this market, in all markets for that matter, but it is becoming more pronounced given this new regulatory environment, which ironically enough was put in place with the hopes of increasing market stability.

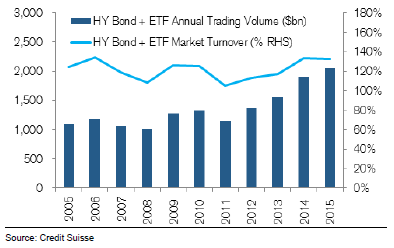

While the perception is that these liquidity concerns equate to a lack of trading activity, the reality is that we are now seeing turnover in the high yield market back to pre-crisis levels.2

High Yield Market Turnover

Trading activity is clearly occurring given the turnover number. However, the general market risk off mentality right now combined with the lack of dealer inventory has led to bigger price swings, and with that increased volatility within the market. Throughout the history of investing we’ve often seen bonds and stocks trade with big swings on factors such as weaker or stronger than expected earnings, competitive or product issues, or some other sort of news, or even just general market sentiment. For instance, it is not unusual to see stocks move 20, 30, 40% on massive volume—just because we see an outsized price move, it doesn’t mean the security is illiquid. Risk is part of investing and in volatile times, price swings can be big, and that is what we are seeing in today’s high yield market. We are seeing pricing issues, but we believe those pricing issues are creating opportunities (see our pieces “The Pricing Issue in High Yield” and “The High Yield Market Repricing: An Opportunity”).

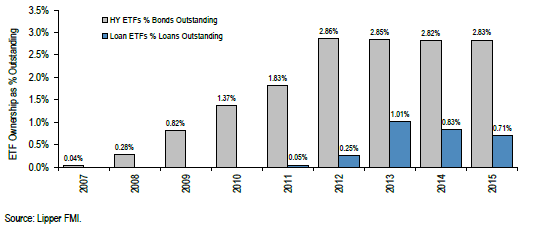

As we discuss liquidity, many seem to point the finger at exchange traded funds (ETFs) as a big part of the problem. Keep in mind, ETFs comprise only about 3% of the almost $2 trillion total high yield bond market.3

High Yield ETFs own less than 3% of all outstanding HY bonds

Of note, high yield bond ETFs have represented about 3% of the market for the last four years. It seems people are under the impression that ETFs have just recently become a bigger force in the high yield market and are all of a sudden causing liquidity issues; however, that is not the case.

Instead, we see ETFs as part of the solution as providers of liquidity to a market that has had periods of lack of buyers and liquidity issues in the past. As a recent Credit Suisse report noted:4

The year [2015] saw institutional investors increasingly frustrated by lack of dealer inventory, which hit record lows, making them resort to HY ETFs and CDX HY as place holders for new cash in the absence of secondary paper available. We think the extra trading and risk transfer capability that the HY ETF markets provides fills a liquidity void left behind by regulatory pressures on dealers.

The regulatory changes have altered today’s high yield market, bringing with them more volatility. This heightened volatility is here to stay and must be something that high yield investors contend with going forward. We believe this volatility is actually an opportunity for active investors who can look to take advantage of the outsized “liquidity premiums” offered to investors in today’s high yield market, whereby investors are able to capitalized on discounts and generate what we see as attractive yields due to market fear and volatility rather than fundamental weakness in many credits. Within this new framework, we believe ETFs give investors instant access to the high yield market and unlike mutual funds, ETFs trade throughout the day, giving investors a more accurate reflection of intra-day pricing dynamics and volatility. We believe ETFs provide investors a great way to access an asset class where we currently see attractive value to be had.