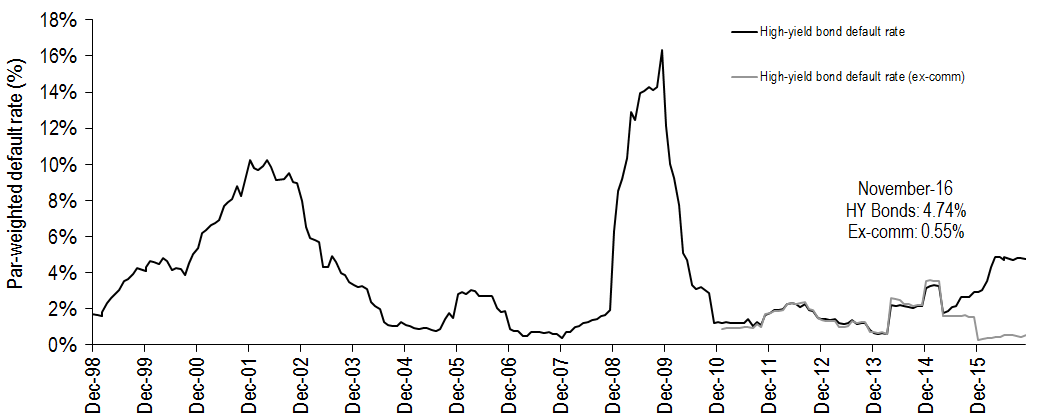

In early 2016, oil was heading into the $20s and market prognosticators were expecting that we’d see a huge spike in energy and commodity related defaults in 2016 and that would continue into 2017. The projection was for a 6% default rate in 2016 for the entire high yield market. 1 As of the end of November, we are looking at 4.7% default rate (including distressed debt exchanges) for the entire high yield bond market, which was dominated by the Energy and Metals/Mining sectors.2 J.P. Morgan recently noted that 84% of 2016 default activity was from commodity related companies, while just $9.3bil over 19 companies defaulted in 2016 in non-commodity sectors, putting the default rate ex-commodities at a very low 0.6%.3

High Yield Bond Default Rates

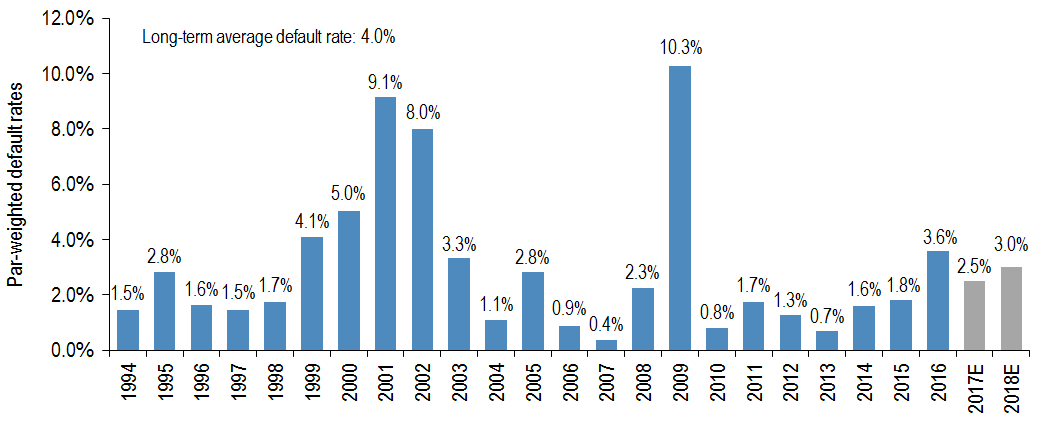

With the weakest of the commodity companies now weeded through and the stability we have seen in energy and commodity prices over the last 6+ months, the projection is now for the default rate to fall down to 2.5% in 2017, putting it well below the historical average of about 4%.4

High Yield Bond Default Rates and Outlook5

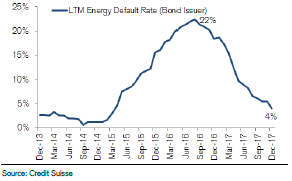

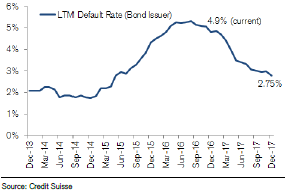

J.P. Morgan isn’t alone in their projections for a significant decline in defaults. Others, including Credit Suisse, profiled below, have similar outlooks with the expectation that both energy/commodity defaults will decline significantly, as will the total high yield bond market rate.6

Energy Default Rates Expected to Collapse

High Yield Bond Default Rates Expected to Halve

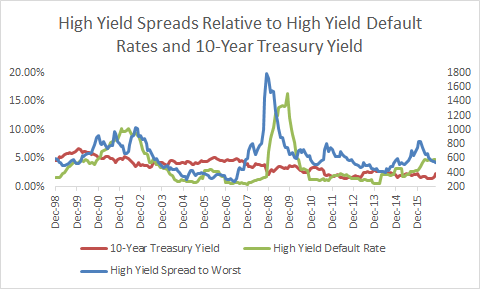

While some seem to be concerned about the impact of higher interest rates on the high yield market, investors need to be aware that the biggest driver of spreads historically is not interest rates (interest rate risk) but rather the default rate and outlook (default/credit risk). As the chart below profiles, spreads spike (bond prices decline/yields increase) when the expectation is for an increase in default rates, and vice versa, as the outlook for defaults decline, spreads tighten (prices increase) historically.7

So whether you believe the new administration’s potential tax, infrastructure, and job initiatives drive the economy and rates along with it, or you believe Treasury rates won’t rise much from where they already are in this post-election euphoria, we don’t expect rates to be the primary driver of the high yield market. Credit/default risk remains at the core of spread movement and as we look into 2017, we believe that the benign default outlook bodes well for the argument for further spread tightening/bond prices increasing in 2017 in the high yield market. Additionally, adding an effective active management overlay on top of this can help to further stem default exposure.

For information on the AdvisorShares Peritus High Yield ETF (ticker HYLD), the actively managed high yield exchange traded fund that the Peritus team is sub-advisor to, please visit, www.advisorshares.com/fund/hyld, distributed by Foreside Fund Services, LLC.