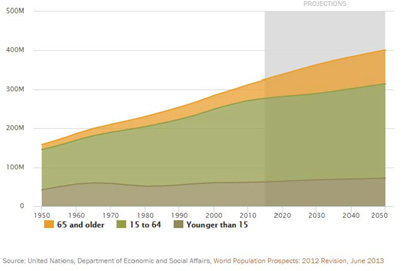

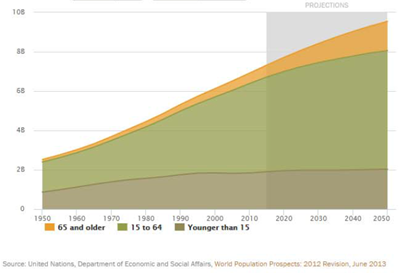

We see demographics as an important factor when considering interest rates and the fixed income market. We are in the midst of a significant global shift in demographics as the baby boom population ages. As we look out over the next 30 years, it is expected that the oldest age groups will be growing rapidly, both in the US and globally.1

U.S. Demographic Trends

Global Demographic Trends

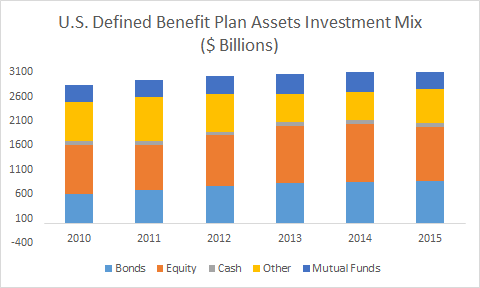

This demographic shift has far reaching implications on a variety of fronts. For us in the fixed income market, we believe that it will create a shift from equities into fixed income, and we are already starting to see the beginning stages of this shift.

For instance, pensions are increasingly focusing on portfolio immunization and liability driven investing. Portfolio immunization involves matching the duration of plan assets with the duration of liabilities, while liability driven investing focuses on matching the future cash flow needs from the liabilities with the income from the assets. Liability driven investing is often utilized by both insurance companies and pensions and requires consistent yield generation to provide the necessary income. On the pension side, we are currently seeing growing allocations to bonds within defined benefit plans, while equity allocations have remained relatively steady.2

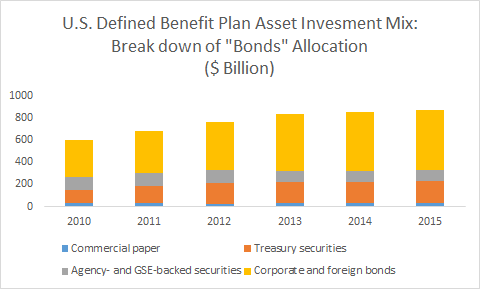

Looking at how that “bond” exposure in the graph above breaks down, we have seen the growth come from the Treasury security and corporate and foreign bond allocations.

We believe these global demographics matter not only for pension investing, but also for retail investing. Be it in 401Ks, IRAs, or other individual retirement plans, as people near or enter retirement, they tend to focus more on income generation and capital preservation and less on growth—they want income they can live off of for years to come.

As we look forward, we expect the demand for Treasuries, corporate bonds, and other fixed income securities to accelerate as demographics take hold. In turn, we would anticipate that this higher demand for assets like Treasuries and overall lower global demand of hard goods and services (consumption) caused by an aging population (who tend to consume more of healthcare but less consumption of many other hard goods and services) to further help constrain interest rates in the years to come (see our piece, “Pricing Risk and Playing Defense” for further detail).

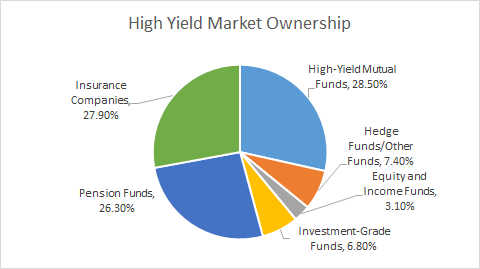

It is also important to keep in mind this demographic shift as you consider the current state of the high yield market. Pensions, insurance companies and retail mutual funds each own about one quarter of the high yield market, with the final quarter comprised of various other funds (hedge, equity, investment grade).3

Again, liability driven investing used by pensions and insurance companies requires consistent yield generation, and the high yield market can work to provide that yield, especially relative to the yield offered by other fixed income alternatives. Considering these demographic trends, we believe this may serve to create a steady and lasting source of demand for high yield bonds as well. As we look at the current high yield market, with spreads below historical average and median levels, we see this demand as another reason that spreads very well could continue to tighten further. People are looking for yield, be it pensions, insurance companies, institutional investors or retail investors, and relative to many other fixed income options, the high yield market still offers what we see as reasonable yield for investors.

1 “Global Population Estimates by Age, 1950-2050.” Pew Research Center, Washington, D.C. (January 30, 2014). http://www.pewglobal.org/2014/01/30/global-population/.

2 Federal Reserve Statistical Release, Financial Accounts of the United States, L.118.b Private Pension Funds Defined Benefit Plans, release date March 10, 2016, https://www.federalreserve.gov/releases/z1/20160310/accessible/l118b.htm.

3 Acciavatti, Peter D., Tony Linares, Nelson Jantzen, CFA, Rahul Sharma, and Chuanxin Li. “2016 High-Yield Annual Review.” J.P. Morgan, North American High Yield and Leveraged Loan Research. December 29, 2016, p. A154, https://markets.jpmorgan.com/?#research.na.high_yield. Data for 2016.