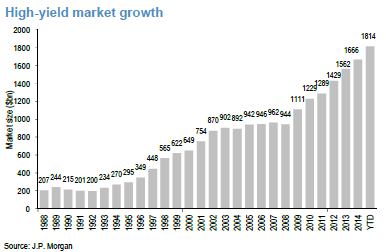

The entire U.S. fixed income market (municipals, Treasuries, mortgages, corporates, federal agency bonds, money market, and asset back securities) totals $39.2 trillion.1 Of this, corporate credit is about $8 trillion. The high yield bond market is a growing piece of that corporate debt piece, now at $1.8 trillion2, and accounts for over 20% of total corporate bonds outstanding. If you add in high yield floating rate loans, that total high yield debt number moves to over 30% of corporate debt.3

One thing is clear, that the high yield bond market is a growing market, and one that cannot be ignored. However, more recently much has been made of high yield exchange traded funds (ETFs), with some critics speculating that some wider-spread selling in high yield ETFs could cause a collapse in high yield markets due to “liquidity” issues. We have previously explained how recent regulations post the financial crisis have led to less market making and lower dealer inventory of bonds, and the impact that has had on markets. However, these arguments for the high yield market’s demise due to these liquidity concerns appear greatly overblown to us.

It is important to keep in mind the size of the high yield ETF market relative to the entire high yield market. The three largest categories of owners of high yield bonds are pension funds, insurance companies, and retail mutual funds, all of which have relatively the same size of ownership at just under a quarter of the market each.4

With this we see both institutional and retail customers as active in the space. High yield ETFs account for about 12% of the total $300 billion “retail” high yield fund base, which includes the much larger mutual fund counterpart, and ETFs account for about 3% of the broader high yield market.5

Flows in and out of these “retail” mutual and exchange traded funds (though we know that various institutions are still buyers of mutual and exchange traded funds so it isn’t entirely retail) can be somewhat volatile week over week, but again, these flows pale in comparison to size of the total market. For instance looking back over the last six months, the largest weekly reported exchange traded and mutual fund flows that have been reported total around $3 billion6, which compared to a $1.8 trillion market means it is under 0.2% of the total market.

While in all markets we constantly see money flowing in and out, we don’t believe that here volatility of fund flows is necessarily the primary factor in the volatility in the high yield bonds prices/spreads; rather in the end fundamentals and market sentiment trump in high yield bond prices/spreads. Thus when you see that market sentiment changing or fundamental concerns emerging, you begin to see prices decline, in some cases more aggressively, just as we have always seen in past cycles.

Additionally, the concern that high levels of “hot money” in these ETFs will jump ship causing market disruption, appears to also be unwarranted. There has actually been little in the way of total money flows into exchange traded funds over the past couple years, so it would seem no recent piling of hot money into the space. As a point of reference, so far in 2015, a mere $450mm in total has flowed into high yield ETFs7 and in the full year 2014, a total of $53mm flowed out of high yield ETFs.8 Again, a blip relative to broader high yield market.

We believe the fear and concern recently expressed for high yield ETFs is misplaced. During times of fundamental or economic concerns or “risk off” trades, it is natural for prices to move down, and in some cases swiftly. That has always been the case for markets, but then again, we can also see swift moves up/recovery as market sentiment improves—markets tend to be manic. High yield ETFs have grown in popularity over the past several years, and while that has had an improvement in accessibility for retail investors, this ETF market is still small relative to the broader high yield market and we don’t buy the argument that this small piece of the high yield pie can lead to the market’s demise. Mutual funds have existed for decades and money flows in and out of those daily, and similar concerns have not been expressed for this market. We believe that if anything, high yield ETFs provide an advantage over mutual funds because ETFs trade/price intra-day, so we would argue provide a more accurate and true pricing mechanism for going in and out of the high yield market than mutual funds that only trade at the end of the day.

We believe that high yield ETFs provide investors great accessibility to what we see as a very attractive asset class. And while the recent regulations may add an element of volatility to the market, we would view this volatility as an opportunity for active managers who can capitalize on discounts. However, we do not expect this volatility to lead to a collapse in the high yield market and believe that investors who abandon this market due to some of these concerns are missing out on the tangible yield it has to offer and the historically better risk adjusted returns versus equities that the high yield bond market has provided.9