The consensus is that rates will be going up, but the consensus has been wrong about rates time and again over the past several years—none of us know the future. What we do know is that the two monsters of debt and demographics remain in the room and nobody is going to change their impacts. And they have a far bigger impact than much of the optical engineering we are now witnessing with Trump-O-Nomics.

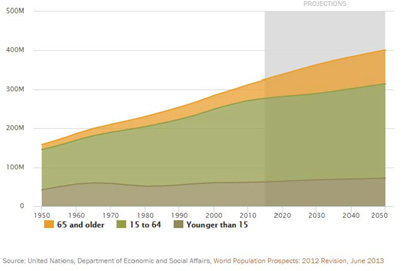

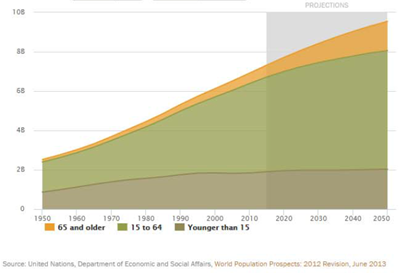

Demographics and a massively levered global economy continue to be the dominant themes. The world is aging and this has enormous economic ramifications, including a shrinking labor force in the richest, most developed countries, swelling pension burdens, and slowing consumption. According to Pew Research, “Growth from 1950 to 2010 was rapid—the global population nearly tripled, and the U.S. population doubled. However, population growth from 2010 to 2050 is projected to be significantly slower and is expected to tilt strongly to the oldest age groups, both globally and in the U.S.” That population shift is graphically pictured below.1

US Demographic Trends

Global Demographic Trends

We expect these demographic trends to have a continued and lasting impact on economic growth and final demand.

Demand and inflation are both considerations as one looks at a potential increase in rates. A focus on bringing manufacturing back onshore can certainly be viewed as a possible source of inflation given that costs to produce the same goods inside the US may be higher. But as prices rise, demand can fall. This is known as the price elasticity of demand. In a no growth world, this elasticity of demand applies to everything from commodities to interest rates. Even ignoring the threatened tariffs, higher interest rates are likely to temper demand from their recent record highs in areas like auto. Think of real estate today. Will higher interest rates help or hurt this industry? We are already seeing the impacts of higher interest rates on mortgage origination. If higher rates are due to a growing and robust economy, demand is more inelastic because everyone is making more money. While the government statisticians continue to tell us we are at full employment and everything is rosy, the real world tells a different story. So in our view we have both price and demand ceilings on most everything.

Oil prices provide an excellent example. As we discussed last year, oil prices in the $20s and $30s were unsustainable as this price did not cover the cost of even the best wells outside of the Middle East. While we are not surprised to see prices above $50, we believe that there is a ceiling on oil prices for a couple of reasons. First, the majority of demand for oil still involves gasoline. While miles driven in the US surprised to the upside in 2016, this was due to the aforementioned price elasticity of demand. As prices collapsed, demand increased. This demand “chip” has been spent. Additionally, excess Chinese demand for storage kicked in during 2016. However, this demand is highly sensitive to pricing. We have seen recent storage demand estimates of around 400,000 bpd, but this demand can simply disappear as prices grind higher. So while gasoline is one of the most “inelastic” commodities it is not perfectly inelastic. We are all inundated with analyst data on supply and the ability of OPEC to bring supply in balance, but for us it is all about demand. We see very little focus on understanding the demand drivers—and ultimately we see these demand drivers as putting a cap on just how much higher oil prices can rally from here.

We also see ceilings on interest rates. The Fed and numerous analysts talk about “normalizing” interest rates. What does that mean? The amount of government, corporate and consumer debt in the world is probably uncountable. So as rates rise, more of everyone’s cash flows go to servicing that debt, stealing buying power away from other areas. Should rates rise too high, this would create defaults in mortgages, corporate bonds and loans and even government bonds. How high is too high? Nobody knows that answer. But what we do know is that we have had effectively zero percent interest rates for eight years now, yet what has that done to stimulate the real economy globally? Not much. So how would higher rates stimulate growth? They won’t. Rather we can be in a situation where higher rates thwarts higher rates because of the demand impact.

So you can see the paradox we are now involved with. The equation is debt + demographics = no demand. We can talk about infrastructure spending, keeping jobs in America, and a reduction in corporate taxes, but we don’t see that as moving the needle enough to outweigh the continued drags from the debt burden and a demographic shift away from consumption of goods. What this means to us as high yield bond investors is that should the Fed pursue further rate hikes, we would expect to see a flattening of the yield curve, with medium to long term interest rates not doing much. Because high yield bonds generally have maturities of 5-10 years, it is these 5-yr and 10-yr US Treasuries that are more relevant to our market, these are the securities off which we price “spreads.” We would expect little in the way of rate pressure to materialize for high yield bonds. To read more on our take on interest rates, the global outlook, and our investment strategy in this environment, see our recent writing “Pricing Risk and Playing Defense.”

1 “Global Population Estimates by Age, 1950-2050.” Pew Research Center, Washington, D.C. (January 30, 2014). http://www.pewglobal.org/2014/01/30/global-population/.