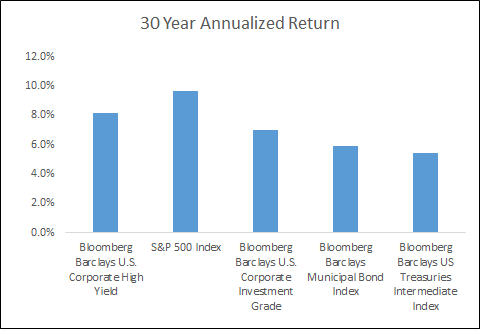

When assessing a portfolio and determining their asset class mix, investors often allocate large portion to equities as this is believed to have a much better longer-term investment return profile than fixed income securities (bonds, loans), while fixed income is generally considered to be less risky and offers a diversification benefit to a portfolio. Balancing return, risk, and diversification are import factors. As we look at today’s investment landscape, for those concerned about escalating equity valuations (see our piece, “A Look at Valuations: Corporate Bonds and Equities”), we believe that high yield bonds may offer investors a viable alternative for a piece of their equity exposure.

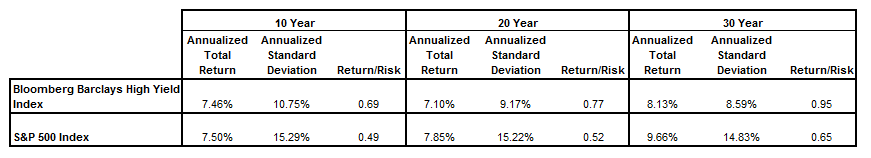

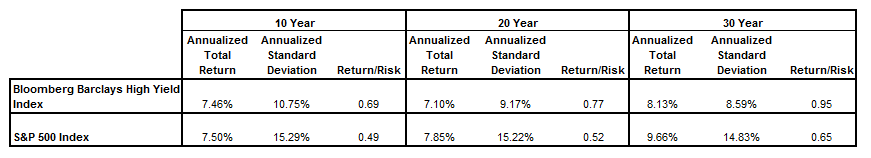

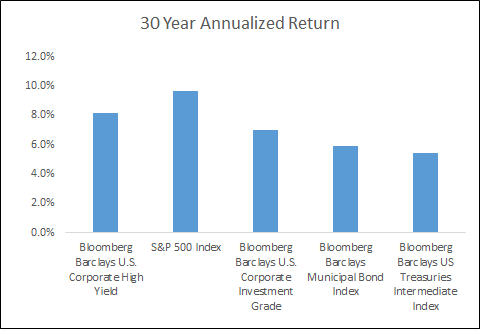

Though high yield bonds are fixed income securities, it is important for investors to understand that over their history, they have had a similar return profile as equities (as measured by the S&P 500) but with significantly less risk.1

Here we are measuring risk as volatility, or the standard deviation of returns. Looking back over the high yield market’s 30 year history of existence, the return/risk metric above demonstrates that the high yield market has significantly outperformed equities on a risk adjusted basis over various historical periods, providing a higher return per unit of risk.

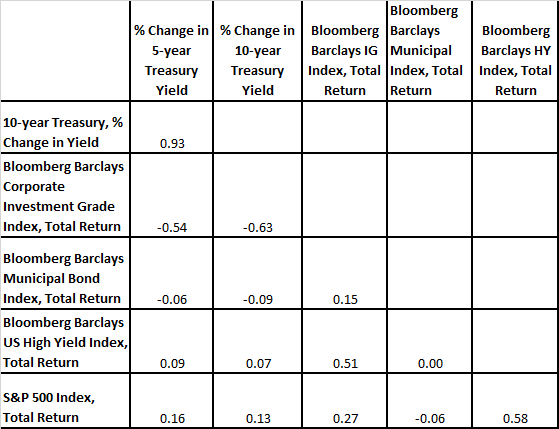

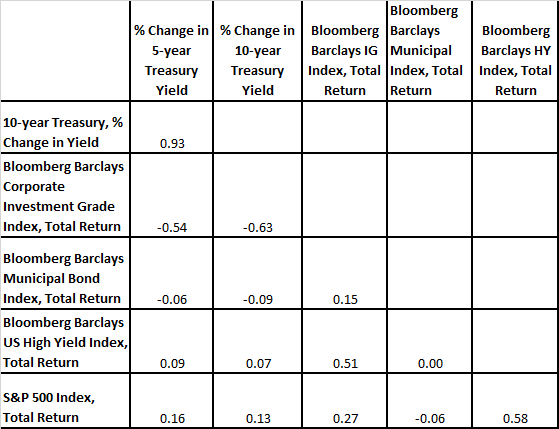

Diversification is also a consideration, and one way to analyze that is to look at the correlation of various asset classes.2

As the chart indicates, high yield bonds and equities are positively correlated, but certainly not perfectly correlated, so there a benefit to including high yield bonds along with equities in terms of reducing a portfolio’s diversifiable risk. Additionally, high yield bonds have an even lower correlation to investment grade bonds, and a very slight to zero correlation to changes in 5 and 10 Treasury yields and municipal bonds; thus high yield bonds would seem to provide a significant diversification benefit to a more traditional, conservative bond allocation, along with a higher return potential.3

Again, history has shown us that high yield bonds have a similar return profile as equities with much lower risk, providing a risk adjust return outperformance. This, along with the diversification benefit, leads us to believe that high yield bonds should be considered as an attractive alternative for a portion of an investor’s equity allocation, especially for investors who currently feel equity prices have gotten ahead of themselves.

1 Bloomberg Barclays Capital U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt (source Barclays Capital). The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. S&P 500 index data sourced from Bloomberg, using a total return including dividend reinvestment. Annualized Total Return and Standard Deviation calculations are based on monthly returns. Return/Risk calculated as the Annualized Total Return divided by Annualized Standard Deviation.

2 Bloomberg Barclays US Corporate Investment Grade Index consists of publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and the quality requirements (source Barclays Capital). Bloomberg Barclays Municipal Bond Index covers the long-term, tax-exempt bond market (source Barclays Capital). S&P 500 index data sourced from Bloomberg, using a total return including dividend reinvestment. Correlations calculated based on monthly returns for the various Bloomberg Barclays indices and S&P 500 and using the monthly percentage change in yield for the 5-yr and 10-yr US Treasury bonds.

3 Bloomberg Barclays Capital U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt (source Barclays Capital). Bloomberg Barclays US Corporate Investment Grade Index consists of publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and the quality requirements (source Barclays Capital). Bloomberg Barclays Municipal Bond Index covers the long-term, tax-exempt bond market (source Barclays Capital). Bloomberg Barclays US Treasury Intermediate is the Intermediate sub-index of the US Treasury Index with includes public obligations of the US Treasury with a remaining maturity of one year or more (source Barclays Capital). The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. S&P 500 index data sourced from Bloomberg, using a total return including dividend reinvestment. Annualized Total Return calculations are based on monthly returns.

Although information and analysis contained herein has been obtained from sources Peritus I Asset Management, LLC believes to be reliable, its accuracy and completeness cannot be guaranteed. This commentary is for informational purposes only. Any recommendation made may not be suitable for all investors. As with all investments, investing in high yield corporate bonds and loans and other fixed income, equity, and fund securities involves various risks and uncertainties, as well as the potential for loss.